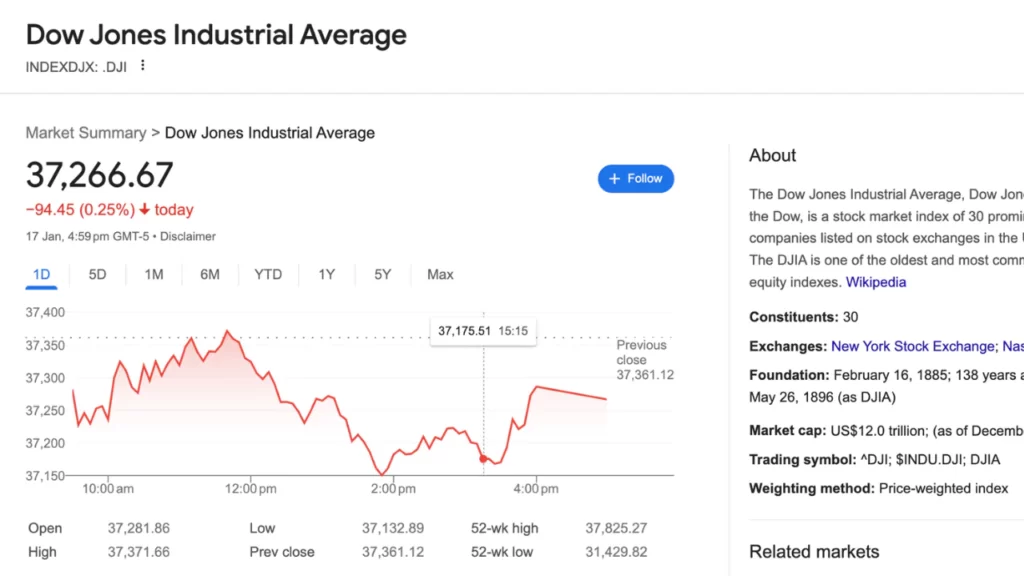

The Indexdjx: .dji, or the Dow Jones Industrial Average (DJIA), is one of the most famous and influential stock market indexes in the world. It tracks the performance of 30 large-cap U.S. companies from various sectors and industries. The index was created by Charles Dow in 1896 to serve as a proxy for the health of the broader U.S. economy. In this article, we will explore the history, components, methodology, and impact of the Indexdjx: .dji on the global financial markets.

Understanding INDEXDJX: .DJI

History and Legacy of DJIA

Financial writers Charles Dow and Edward Jones published the DJIA on May 26, 1896. Back then, the index tracked the 12 largest corporations in each U.S. stock market sector. The first reported Dow Jones value was 40.94, based on the average market price for 12 businesses. Dow & Jones used the index to inform investors of stock market health. While working at Dow, Jones & Co. since 1882, they published the Customer’s Afternoon Letter, a daily financial newsletter that summarized stock prices and news. The company published The Wall Street Journal later.

Investors had little accurate financial data at the time. Companies often hid or twisted facts, making investors wary. Thus, the Dow Jones Industrial Average was needed to increase investor trust in the stock market.

The 12 original corporations that represented every market category except railroads and transportation were:

- American Cotton Oil

- American Sugar

- American Tobacco

- Chicago Gas

- Distilling & Cattle Feeding

- General Electric

- Laclede Gas

- National Lead

- North American

- Tennessee Coal & Iron

- U.S. Leather

- United States Rubber

Over time, the index expanded to include 30 companies, reflecting the growth and diversification of the U.S. economy. The index also underwent several adjustments to account for stock splits, dividends, mergers, and other corporate actions that affected the stock prices. The index is now calculated by dividing the sum of the stock prices by a divisor that is updated periodically to ensure continuity in the index’s value.

DJIA is the second-oldest U.S. market index after Dow Jones Transportation Average. The DJIA was created to gauge the U.S. economy. The Dow is one of the most monitored stock market indexes in the world. While the Dow comprises several companies, all are blue-chip companies with reliable earnings. Industrial enterprises’ performance was connected to economic growth in the early 20th century. That solidified the Dow’s correlation with the economy. Even today, many investors associate a strong Dow with a healthy economy and a weak Dow with a declining economy.

Components and Methodology of INDEXDJX: .DJI

The DJIA has 30 significant publicly-owned enterprises that reflect the US economy. The index composition changes with industry dynamics. The INDEXDJX.DJI weights its component firms’ prices rather than market capitalization. Thus, even if their market capitalization is smaller, companies with higher stock prices significantly affect the index.

The companies in the Dow Jones can vary and include dominant players in sectors such as technology, healthcare, finance, consumer goods, and manufacturing. Some examples include:

- Apple Inc.

- Microsoft Corporation

- Visa Inc. Class A

- UnitedHealth Group Incorporated

- JPMorgan Chase & Co.

- Johnson & Johnson

- Walmart Inc.

- Procter & Gamble Company

- Home Depot, Inc.

- Chevron Corporation

- Merck & Co., Inc.

- Coca-Cola Company

The composition of the Dow Jones Industrial Average does not have a fixed schedule for changes. Adjustments to the index can occur as needed to ensure that it continues to represent the U.S. economy accurately. Typically, changes to the Dow’s composition might happen due to:

- Mergers and Acquisitions: If one company within the Dow acquires another or merges, it may lead to a change in the index composition.

- Corporate Restructuring: If a company undergoes significant restructuring or faces substantial financial difficulties, it might be replaced.

- Shifts in Industry Significance: As various industries rise and fall in importance within the economy, the Dow’s composition may be adjusted to reflect those shifts.

- Changes in Stock Price: Since the Dow is a price-weighted index, significant changes in the stock price of individual companies might prompt adjustments to ensure that the index remains balanced.

Though changes to the Dow’s composition are relatively infrequent, they are essential to maintain the index’s relevance as a barometer of the American economy. The selection of companies for the Dow Jones Industrial Average is a carefully considered process overseen by a committee. The committee is composed of the managing editor of The Wall Street Journal, the head of the Averages Committee, and the head of Dow Jones Indexes research.

The index is calculated by adding the stock prices of its 30 components and dividing the total by a divisor that accounts for stock splits, dividends, and other adjustments to ensure continuity in the index’s value over time. The divisor as of November 10, 2023 was 0.151987075.

Impact of INDEXDJX: .DJI on the Global Financial Markets

Role in Measuring Market Performance

Americans closely follow the DJIA, a blue-chip stock index. It shows investor mood and DJIA performance forecasts. Stock prices can be affected by market sentiment changes in futures pricing.

Other indices, sectors, industries, and equities are compared to the DJIA. The DJIA can help investors assess an industry or company’s performance. Mutual funds, ETFs, and index funds use the DJIA as a benchmark to mimic or beat its performance.

DJIA is not the sole or best market indicator. Critics say the DJIA is biased, antiquated, and narrow. The DJIA only tracks 30 companies, which may not reflect the U.S. economy’s diversity and complexity. Since the DJIA is price-weighted, higher-priced companies are given greater weight regardless of market capitalization, quality, or relevance. Amazon, Google, Facebook, and Netflix, among other significant and innovative U.S. corporations, are not in the DJIA.

Investors should not only rely on the DJIA to evaluate market success. They might also examine the S&P 500, which measures 500 large-cap U.S. firms and is weighted by market capitalization, and the Nasdaq Composite, which tracks over 3,000 technology companies. These indexes may better summarize market trends and situations.

Influence on Global Economy

While measuring the U.S. stock market, the DJIA also measures the U.S. economy and its significance in the world. The U.S. accounts for 24% of global GDP in 2020. The US is the world’s largest consumer market, importer, exporter, and FDI source and destination. Thus, the U.S. economy’s performance and forecast affect the world.

As an indicator of the U.S. economy, the DJIA can affect global markets. When the DJIA rises, it may indicate a healthy U.S. economy, boosting worldwide trade, investment, and confidence. When the DJIA declines, it may imply a poor and declining U.S. economy, which may reduce worldwide commerce, investment, and confidence. The DJIA can also affect the value of the U.S. dollar, the world’s reserve currency and most extensively utilized in international transactions. Rising or decreasing DJIAs may strengthen or weaken the dollar. The dollar’s value affects other countries’ exports, imports, foreign exchange reserves, and debt commitments.

The DJIA can also affect the monetary and fiscal policies of other nations, particularly those closely tied to the U.S. economy like Canada, Mexico, China, and the EU. When the DJIA rises, the Fed may hike interest rates to prevent inflation and overheating. Other central banks may follow suit to ensure currency rate stability and minimize capital outflows. However, a falling DJIA may lead the Fed to decrease interest rates to boost growth and spending. Other central banks may follow suit to prevent their currencies from gaining too much and damaging exports. A falling DJIA may also prompt U.S. fiscal stimulus, like as tax cuts or spending increases, to support the economy. This may affect other countries’ fiscal policy by increasing demand for their goods and services or borrowing prices.

The DJIA can also impact U.S. geopolitical and strategic relations, particularly with significant trading partners, friends, and enemies. The DJIA’s increase may boost the U.S.’s global leadership, power projection, and interest protection. The DJIA’s decline may weaken the U.S.’s global leadership, power projection, and interest protection. The DJIA can also affect the U.S.’s foreign cooperation, conflict resolution, and attitude on trade, climate change, human rights, and security.

Accessibility for Individual Investors

The DJIA is not only a tool for measuring and influencing the market and the economy, but also an opportunity for individual investors to participate in and benefit from the stock market. The DJIA is widely accessible and easy to understand for investors of all levels of experience and sophistication. Investors can access the DJIA through various channels, such as:

- Directly buying the stocks of the 30 companies that make up the index. This requires a large amount of capital and may incur high transaction costs and taxes.

- Buying index funds or ETFs that track the performance of the DJIA. This requires a lower amount of capital and may offer lower transaction costs and taxes, as well as diversification benefits.

- Buying futures or options contracts that are based on the DJIA. This allows investors to speculate on the future movements of the index or hedge against the risk of adverse price changes.

- Buying other financial products or instruments that are linked to the DJIA, such as mutual funds, bonds, certificates of deposit, or structured notes. These may offer different levels of risk and return, depending on the underlying terms and conditions.

Investing in the DJIA can offer several advantages for individual investors, such as:

- Exposure to the U.S. economy and its growth potential. The DJIA represents some of the most successful and influential companies in the U.S., which have a strong track record of innovation, profitability, and resilience. Investing in the DJIA can allow investors to benefit from the performance and prospects of these companies and the U.S. economy as a whole.

- Diversification across sectors and industries. The DJIA covers a wide range of sectors and industries, such as technology, healthcare, finance, consumer goods, and manufacturing. Investing in the DJIA can help investors reduce their portfolio risk and volatility by spreading their exposure across different segments of the market.

- Long-term returns and dividends. The DJIA has historically delivered positive returns and dividends over the long term, despite periodic fluctuations and downturns. Investing in the DJIA can help investors achieve their long-term financial goals and generate a steady income stream.

However, investing in the DJIA also involves some risks and challenges for individual investors, such as:

- Market risk and volatility: The DJIA is subject to the fluctuations and uncertainties of the market, which can be influenced by various factors, such as economic conditions, political events, corporate news, investor sentiment, and global trends. Investing in the DJIA can expose investors to the risk of losing money or missing out on better opportunities if the market moves against their expectations or preferences.

- Tracking error and fees: The DJIA is not a perfect representation of the market or the economy, as it only includes 30 companies and uses a price-weighted methodology. Investing in index funds or ETFs that track the DJIA can result in tracking error, which is the difference between the performance of the fund or ETF and the performance of the index. Tracking errors can be caused by various factors, such as fund management, rebalancing, dividends, taxes, and expenses. Investing in index funds or ETFs also involves paying fees, such as management fees, expense ratios, commissions, and spreads, which can reduce the net returns for investors.

- Liquidity and availability: The DJIA is not a tradable entity, but a calculated value. Investing in the DJIA requires accessing other financial products or instruments that are based on or linked to the index. These products or instruments may have different levels of liquidity and availability, depending on the market conditions, supply and demand, and regulations. Investing in the DJIA may require investors to deal with issues such as bid-ask spreads, market depth, trading hours, settlement periods, and counterparty risk.

- Therefore, investors should carefully weigh the pros and cons of investing in the DJIA, as well as their own objectives, risk tolerance, and time horizon, before making any investment decisions. Investors should also conduct thorough research and analysis, as well as seek professional advice, if necessary, to ensure that they understand the nature and implications of their investments.